You will not have problems if you recognize the formula.

#How to graph efficient frontier in excel how to#

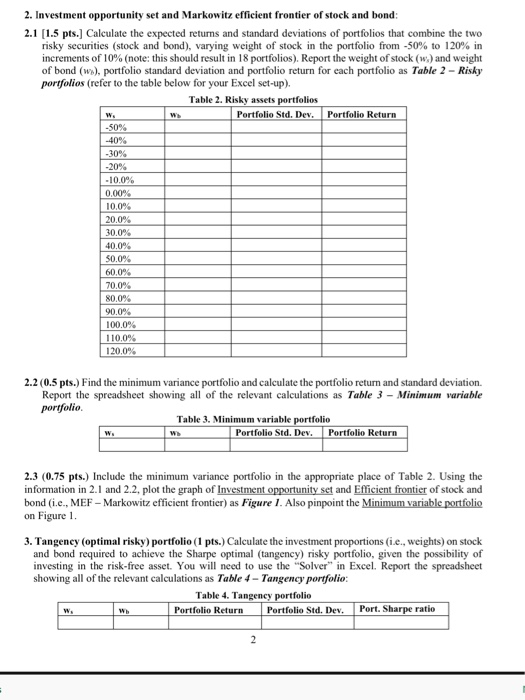

In order to make use of Excel worksheets to do the task that you want, it is needed to understand how to make use of the formulas and data that are included in the design template. 6 Efficient Frontier Excel Template | Efficient Frontier Excel Template SampleTemplatessĮfficient frontier excel template worksheets gives your Excel worksheet more flexibility.

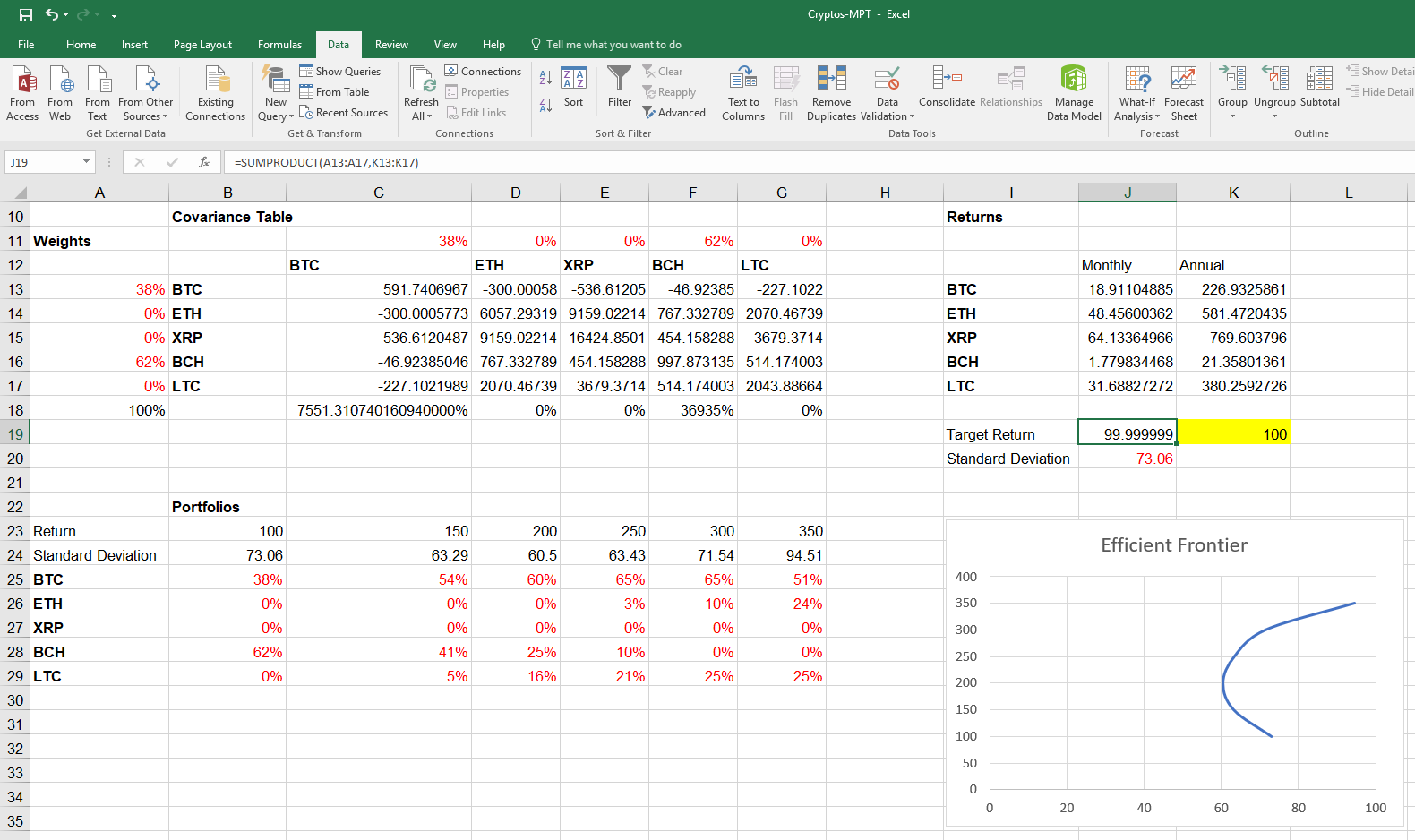

The factor of (E(R) – r f)/σ P) measures the return in addition to the risk-free rate per unit of risk. Where E(R) is the expected return on the portfolio of the risk-free asset and risky assets, r f is the risk-free rate, σ P is the standard deviation of the portfolio of risky assets and σ is the standard deviation of the new portfolio (comprising of both the risk-free rate and the risky assets). US treasury securities can be considered risk-free assets for this analysis.Įxpected return of a portfolio of a risk-free asset and a portfolio of risky asset can be determined using the following formula: Risk-free asset is an asset that has zero risk i.e. If an investor has an option to borrow and lend at the risk-free rate, he can create an asset allocation which is a mix of the risk-free asset and the portfolio of risky portfolio. The point on efficient frontier that has the lowest risk is called the global minimum variance portfolio. You might want to review the article on risk and return to obtain an understanding of the portfolio expected return, portfolio standard deviation and their interplay using the efficient frontier.Ī well-diversified portfolio of risky assets has zero unsystematic risk. It is a special case of capital allocation line that is tangent to the efficient frontier and the slope of the capital allocation line represents the Sharpe ratio. Capital market line is the graph of the required return and risk (as measured by standard deviation) of a portfolio of a risk-free asset and a basket of risky assets that offers the best risk-return trade-off.

0 kommentar(er)

0 kommentar(er)